Superannuation rates and thresholds updates

Super guarantee rate now 12%: what it means for employers

From 1 July 2025, the superannuation guarantee (SG) rate officially rose to 12% of ordinary time earnings (OTE). This is the final step in the gradual increase legislated under previous reforms.

What’s changed?

Old rate: 11.5% (up to 30 June 2025)

New rate: 12% (from 1 July 2025)

This increase affects cash flow, payroll accruals and employment contracts, especially where total remuneration includes superannuation.

Employer checklist

Update payroll software: ensure systems are calculating 12% SG correctly from 1 July 2025 pay runs.

Review employment agreements: if contracts are set to inclusive of super, the take-home pay of employees may reduce unless renegotiated or the employer decides to bear the cost of the increased SG rate.

Budget for higher super contributions: consider possible cash flow impacts.

Remember that significant penalties can be imposed for late or incorrect SG payments, including loss of deductions, interest and other administration charges.

Personal superannuation contributions

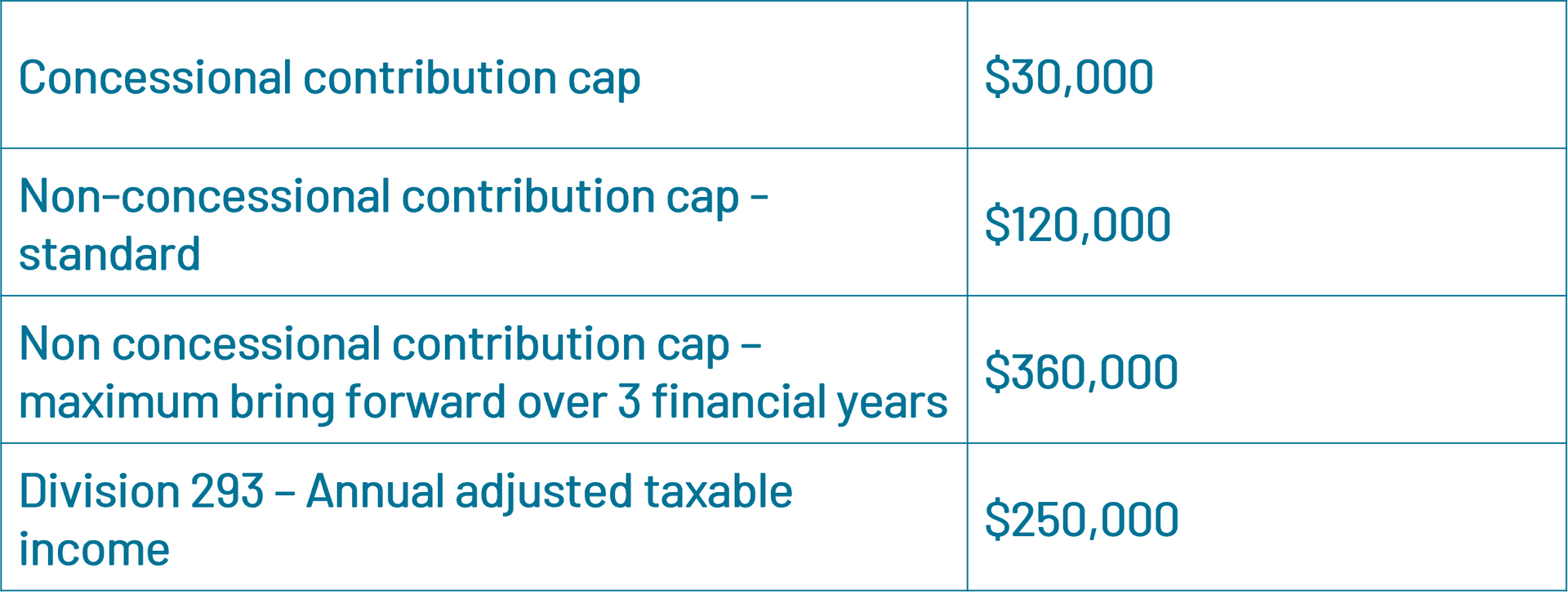

The annual concessional contribution cap will remain at $30,000 for the 2025/2026 financial year. The annual non-concessional contribution (NCC) cap is set at four times the concessional contribution cap meaning it will also remain at $120,000.

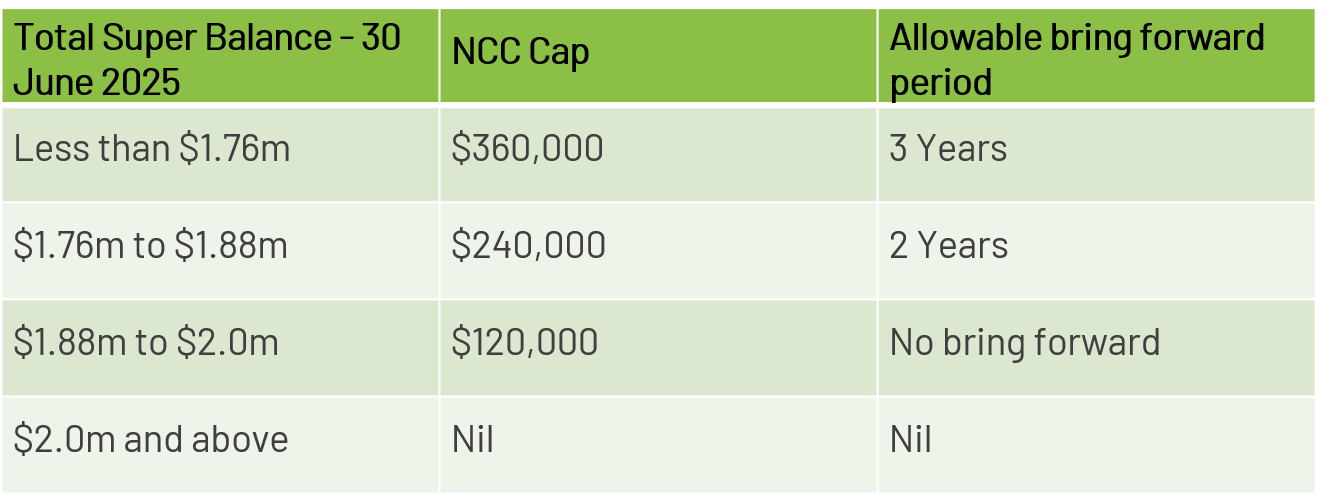

Although the annual NCC cap has not changed, NCCs can now be made by individuals with a total super balance (TSB) of less than $2,000,000 on 30 June 2025 (assuming they have not reached the age 75 deadline and any prior bring forward periods are considered). This is due to the fact that the upper TSB limit links to the general transfer balance cap (TBC) which has increased to $2,000,000.

The relevant TSB amounts for NCCs in the 2025/2026 financial year are summarised in the table below:

Personal deductible contributions

A superannuation fund member may be able to claim a deduction for personal contributions made to their super fund with personal after-tax funds. A member will normally be eligible to claim a deduction if:

- The member makes an after-tax contribution to their superannuation fund in the relevant financial year

- They are aged under 67 or 67 to 74 and meet a work test or work test exemption

- They have provided the superannuation fund with a valid notice of intent to claim

- The super fund has provided the member with acknowledgement of the notice of intent to claim

Notice of intent to claim

If the member is eligible and would like to claim a deduction, then they must notify their super fund that they intend to claim a deduction. The notice must be valid and in the approved form – Notice of Intent to Claim or vary a deduction for personal super contributions (NAT 71121).

The tax legislation provides a notice of intent to claim will be valid if:

- The individual is still a member of the fund

- The fund still holds the contribution

- It does not include all or part of an amount covered by a previous notice

- The fund has not started paying a super income stream using any of the contribution

- The contributions in the notice of intent have not been released from the fund that the individual has given notice to under the FHSS scheme

- The contributions in the notice of intent don't include FHSSS amounts that have been recontributed to the fund.

What you need to consider

The member must provide the notice of intent to claim to the fund by the earlier of:

- The day the individual lodges their income tax return for the relevant financial year; or

- 30 June of the following financial year in which the individual made the contribution.

However, if a super fund member provides a notice of intent after they have rolled over their entire super interest to another fund, withdrawn the entire super interest (paid it out of super as a lump sum), or commenced a pension with any part of the contribution, the notice will not be valid.

This means the individual will not be able to claim a deduction for the personal contributions made before the rollover or withdrawal.

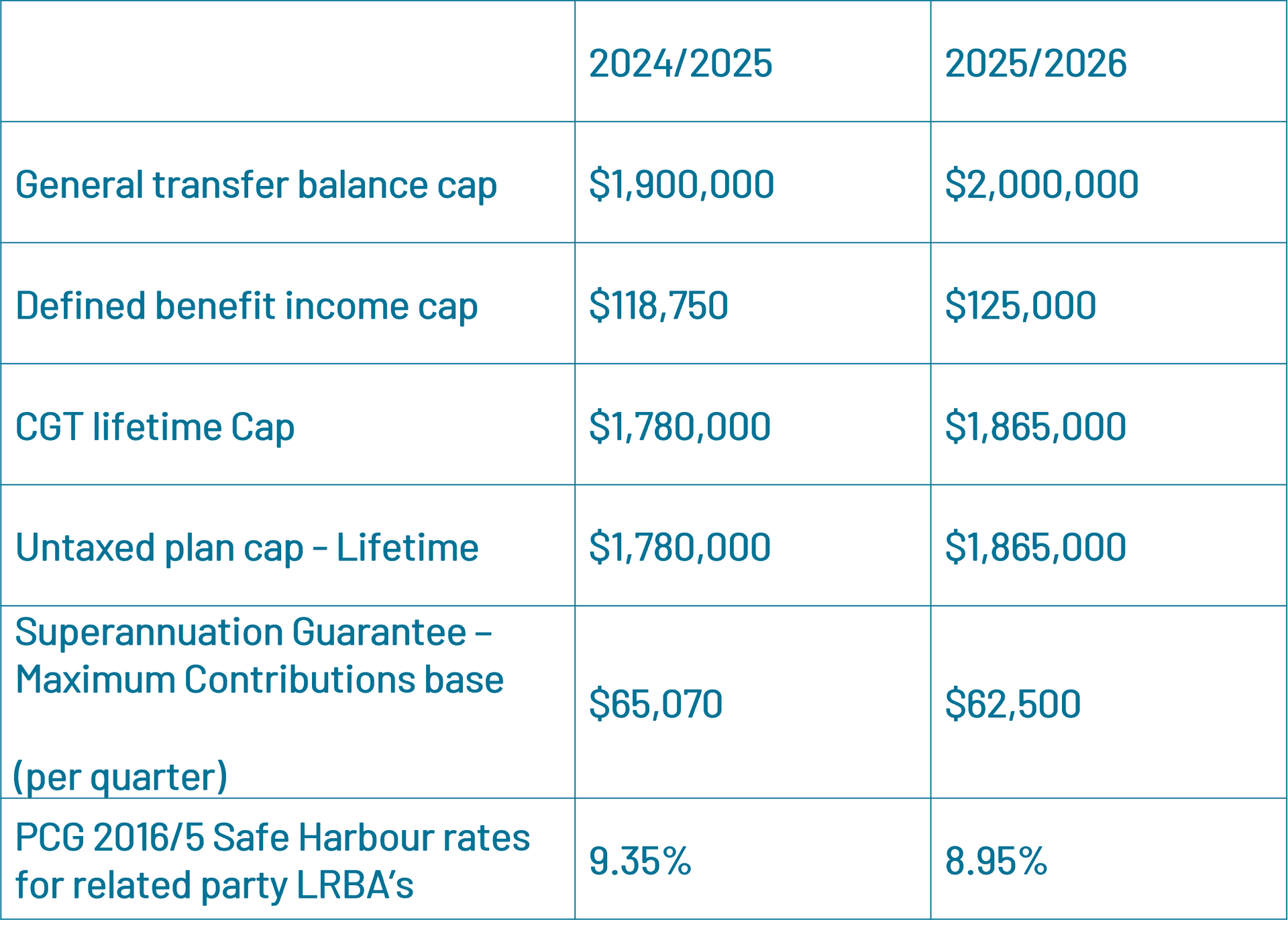

Updated Superannuation and Tax Thresholds: 2025/2026

Remaining unchanged

The following thresholds will remain unchanged for the 2025/2026 financial year.