From 1 November working Australians' will be ‘stapled’ to their existing super fund. This means that you will be attached to a single super fund for life unless you nominate a new fund.

Why?

The new rules are designed to stop people collecting multiple super funds across their working life and prevent them from amazing in duplicate fee and insurance, wasting money and decreasing their super in retirement

What does stapling mean and what are the implications?

If you are an employee, this means when you change jobs your super fund will move with you from your last position, unless you actively change it. If you don’t have a stapled super, and don’t nominate one, your employer will create an account for you with their default fund.

This makes both choosing your fund, and then as your financial and work situation evolves, reviewing your fund (and linked insurance), incredibly important. Remember the insurance you choose through your super at 20 may not be relevant to you at 35 – it’s always worth reviewing it.

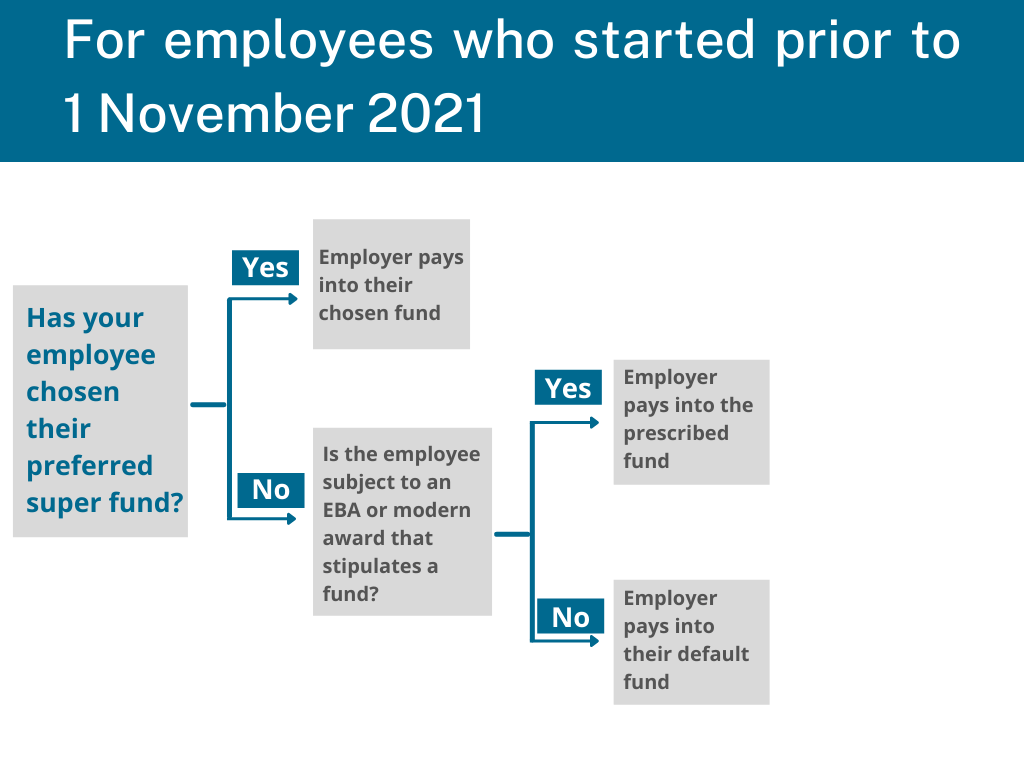

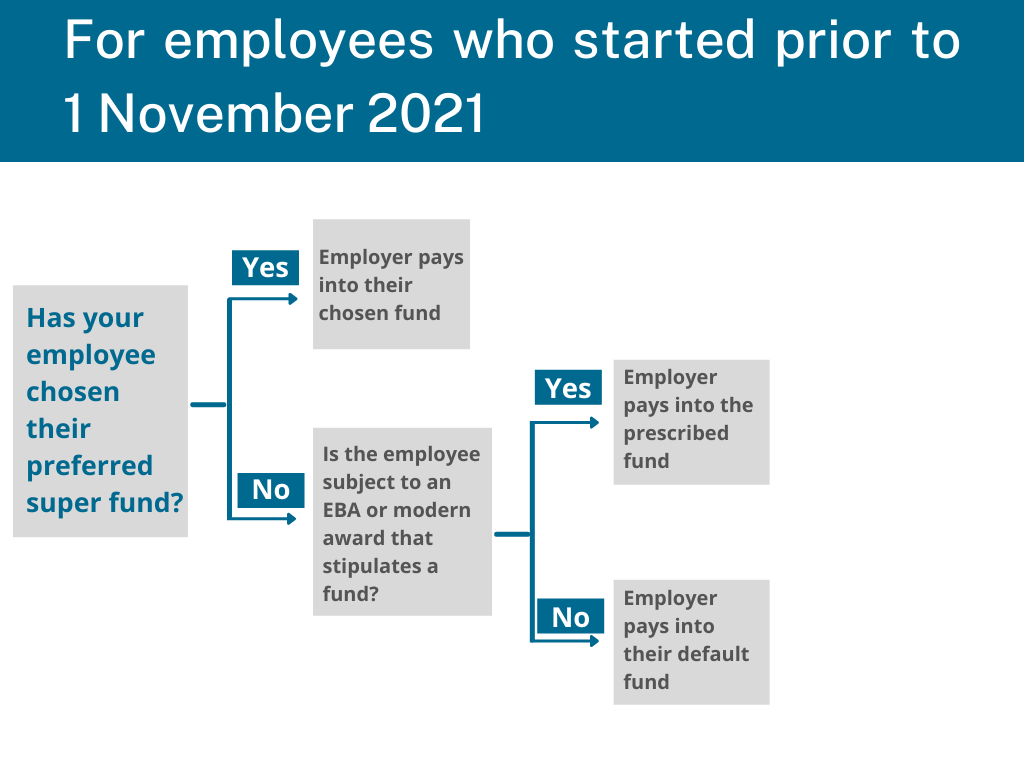

If you are an employer, new employees will be required to fill in an ATO Choice of Superannuation Fund choice form, if they make a super choice this needs to submit to your HR/ payroll team.

If they don’t choose a super fund, then you will need to check the ATO database to see if your new employee has a stapled super fund – details for how this can be done will be announced on the ATO website from 1 November, or contact your Aspen Corporate Advisor for assistance.

If they don’t have a fund, you can use your business’s default fund, or the fund named by your employees EBA.

Implications for employers

What if an employee has multiple accounts?

If an employee has multiple funds, then the ATO will automatically ‘staple’ them to the fund that has been most recently active (received a contribution). When there is more than one active fund the ATO has rules in place to determine the most appropriate fund, such as the fund with the biggest balance.

What if there are hundreds of new employees?

The ATO has developed a process to assistance businesses if they are onboarding over 100 new employees. Contact the ATO for their bulk request form from 1 November.

If you have questions about the changes to super, contact your Aspen Corporate Advisor.